New to commercial or asset finance? Here are some benefits of using a finance lender:

Benefits of asset finance

New credit line: Finance lets you access a new line of credit alongside your existing bank facilities.

Quick access to funding: As a business owner, contractor, dealer or owner operator providing services / completing projects, time and resources may not always be on your side. Access funding as and when you need it through finance.

Finance secured against existing assets: In most cases only your existing business assets (equipment / vehicles etc) are secured against your finance plan.

Fixed interest rates: All of our finance plans come with fixed interest rates and monthly repayments so you can easily budget business expenses.

Long lease: Our repayment terms are available from 12 – 84 months and agreed to suit your business requirements.

For more information about which finance plan is best for you talk to an adviser on 0800 727 101 or email info@partnersfinance.co.nz

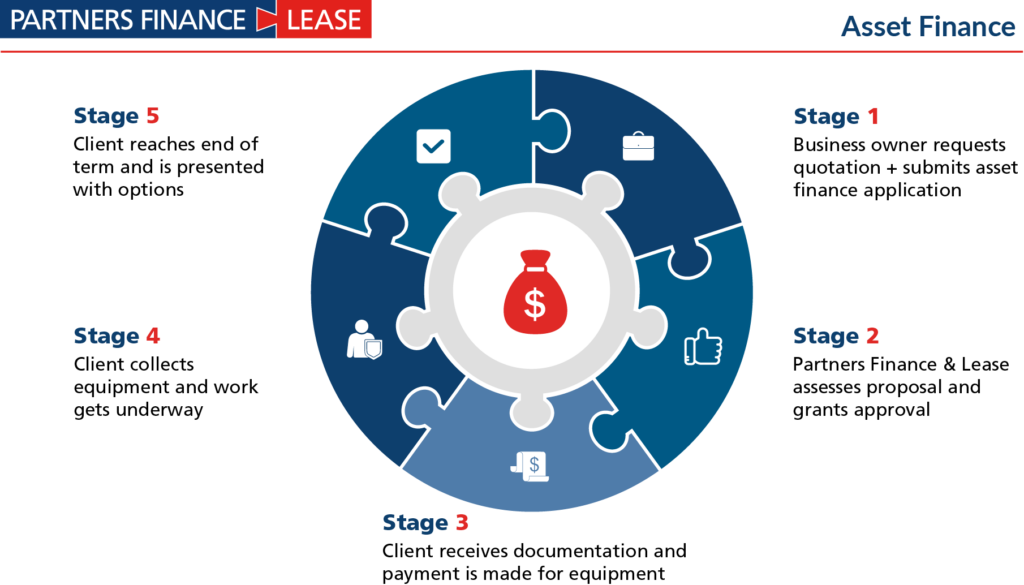

Our asset finance process

How does the process work? The following diagram explains the 5 stages to asset finance with Partners Finance & Lease.

- Business requests quotation and submits finance application

- We assess proposal and grant approval

- We distribute documentation and client makes payment for equipment

- Client collects equipment and work gets underway

- Client reaches end of term and is presented with options

Apply for equipment finance

To receive a quote for your business call 0800 727 101 or apply now.