Asset Finance

Finance for your business

Do you need new equipment, machinery or vehicles to support business growth? Have you considered asset finance? Partners Finance & Lease is a commercial non bank lender with an experienced team who are experts in finance and leasing products.

Knowing what finance options are available to you is key to ensuring the best approach when the need arises for your business to buy new gear.

Asset finance allows you to invest in equipment and machinery when your business needs it rather than when you have the funds available. By taking advantage of financing your new equipment or machinery, you can continue growing the business as you repay the loan over a longer period.

Simple loan agreements

A dedicated, confidential, personal service means no call centre to navigate. Our team prides themselves on tailoring our commercial finance and asset leasing products to suit clients business needs and circumstances. Simple loan agreements and documentation streamlines the paperwork to ease access to business finance and leasing.

Whether you need finance now or in the future, we are able to fund equipment and vehicles for one off deals or form longer term partnerships. Our services are frequently used alongside a business’s existing banking facility to help spread the load and increase flexibility within the firm.

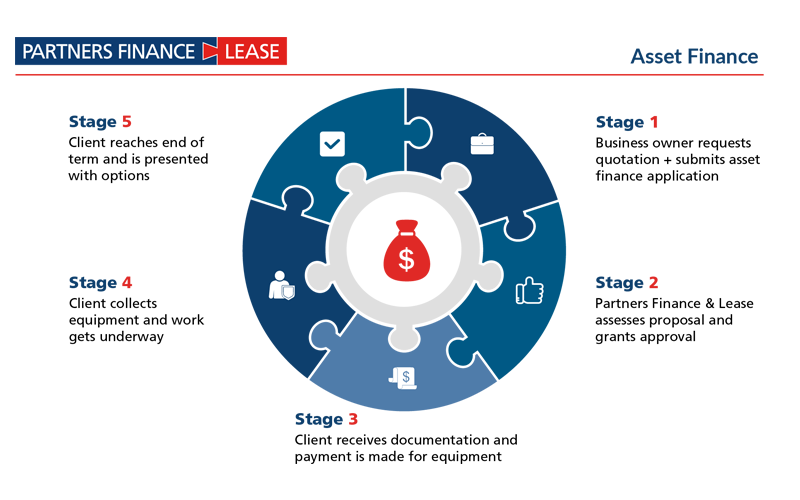

Our finance process

We like to keep our process as simple as possible to ensure your business can access equipment and machinery as soon as possible.

Our finance products

Knowing which product you need can be confusing. Our team will work closely with you to fully understand your business and provide a finance solution which is most cost effective.

More information about our finance products can be found below. To speak to one of the team call 0800 727 101 or click here to apply.

Partners Finance Lease:

Lease agreement against a single asset with a known residual from day one

Features

- Terms from 12-84 months

- Security is solely against the asset being leased

- Varying residual values available resulting in reduced monthly payments

- GST neutral – paid and claimed monthly

- For new or used assets

- Low documentation fee

- Fixed interest rate and monthly repayments

Benefits

- New line of credit – preserves existing banking facilities

- Residual value can more truly reflect asset’s useful life

- Structure can match income to payments

- No unexpected GST surprise in month three

Conditional Purchase Agreement (Hire Purchase)

Features

- Simple way of financing a new asset

- Terms from 12-84 months

- No requirement for bank approval

- Security is over the asset being purchased

- Fixed interest rate and monthly repayments

- Low documentation fee

- Low and no deposit available

- Repayments tailored to suit client circumstances

Benefits

- Use cash more productively in other areas of your business

- Maintain your existing banking lines

- Builds equity in the asset

- Fixed monthly repayments simplify budgeting

- Sell asset without having to re-document other facilities

- No costly legal fees required

Term Loan

A loan secured against existing or newly acquired assets

Features

- Terms of 12-84 months

- Fixed term, fixed interest rate

- Repayments structured to meet your cash flow

- Fixed interest rate and monthly repayments

- Low documentation fee

Benefits

- A new line of funding separate from your banking facilities

- Fixed interest rate and fixed term provide certainty for outgoings/cash flow

- Use capital more productively elsewhere in the business

- Useful when importing fixed assets

Operating lease

Use of an asset over an agreed term for a fixed monthly payment

Features

- Fixed operating cost

- For new and used assets

- Fixed interest rate and monthly repayments

- Low documentation fee

Benefits

- Reduces risks associated with ownership

- Less administration

- Maintains existing banking facilities

- No impact on the balance sheet

- Reduces risk of ownership

- No impact on capital expenditure budgets

- Cashflow certainty

Working capital

A loan secured against existing plant / equipment / motor vehicles to enable funds to be used elsewhere in the business

Features

- Terms of 12-84 months

- Fixed interest rate and monthly repayments

- Low documentation fee

Benefits

- Frees up cash tied up in your assets for more productive use elsewhere

- Allows you to maintain existing banking lines

- Can provide for better terms of trade with suppliers

What next?

For more information or to discuss a plan tailored to your business needs call the team on 0800 727 101 or click here to apply.