Why Us

Partners Finance & Lease is proud to be a longstanding lender. Not only are we experts in commercial finance and asset leasing products, we understand business and are specialists in transport and equipment.

When it comes to business, do you prefer working directly with a decision-maker? Here at Partners Finance & Lease we’re proud of our relational approach to asset finance which continues to be a core value since it was founded by CEO Francis Fitzgerald in 2003.

Asset finance

We offer nationwide coverage wherever you are. Whether it’s finance on a new truck for an owner-driver in Timaru, a Methven manufacturer, frost fans at a Queenstown vineyard, or fleet finance for utes heading to a contractor’s yard in Invercargill.

Our team pride themselves on delivering a dedicated, personal service without a convoluted string of complexities. There are no long-winded call centres to navigate which means we guarantee the same point of contact every time.

Financing New Zealand business

Being a non-commercial lender allows us to tailor our asset finance and commercial loan products to suit your needs and circumstances. Once we’ve understood your requirements, we will provide a straightforward process so you can spend essential time elsewhere.

Our asset finance solutions include:

-

Conditional purchase agreement (hire purchase)

-

Finance Lease

-

Term Loans

You can read more about asset finance products here.

Plant and equipment finance

We finance a range of plant and equipment. From trucks and trailers, utes and cars, construction equipment, machinery, communications, medical, forestry – talk to us today about your next asset purchase.

Why Partners Finance & Lease?

A non-commercial bank lender: By being a non-bank lender is means we’re often less demanding, meanwhile more understanding than traditional lenders.

Additional funding option: Open a new line of credit while preserving your existing banking facilities.

New or pre-owned equipment: We provide finance for all types of equipment.

Low or no deposit: Up to 100% finance available.

Flexible terms: Repayment terms available from 12-84 months.

Short lines of communication: You’ll get your own dedicated adviser guaranteeing the best level of care and attention.

Own or hire: Our finance lease provides a cost-effective solution when compared to hiring transport assets over a long term period.

GST neutral: Pay and claim GST every month with our lease.

Residual / balloon payments: Reduce monthly repayments with residual values starting from $1.

Fixed interest rates: Fixed rates and monthly repayments.

What our clients say

Michael Esposito, MD – Christchurch Attractions: “Having known Francis for more than 20 years and Partners Finance & Lease since its inception, I can always rely on the team to provide out of the square solutions that are tailored to our needs. They are easy to deal with and always provide a positive approach to business. I thank the team for their dedication to date and look forward to a continued relationship.”

John Townshend, Chairman of Directors Texco Group: “Francis and Partners Finance & Lease have always treated our requests with efficiency and honest advice. Availability of finance for plant and equipment is crucial to Texco’s future as contractors. The team provides a vital link in the process of turning money into machines. We are very happy to endorse their growth and thank them for the association to date.”

Pat Lagan, Director of Adams & Currie Ltd: “We use Partners Finance & Lease for all our own vehicles as well as a first point of contact for customers wanting finance and leasing. The staff are extremely friendly and go out of their way to provide excellent service. I have no hesitation in recommending Partners Finance & Lease.”

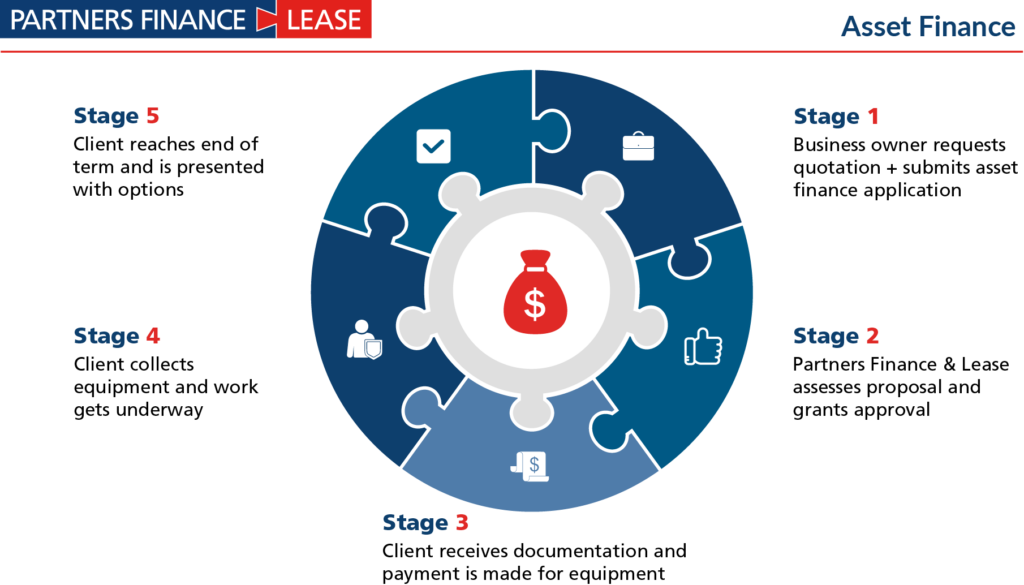

Our finance process

How does the process work? The following diagram explains the five simple steps to financing with Partners Finance & Lease. You can find out more here.

What next?

To apply for finance, click here. Alternatively, call 0800 727 101 or email info@partnersfinance.co.nz to speak to an adviser about your requirements. Or if you’re looking to download our Forklift and Motor vehicle matrices please click the downloadable links here: Download Forklift Matrix Download Motor Vehicle Matrix